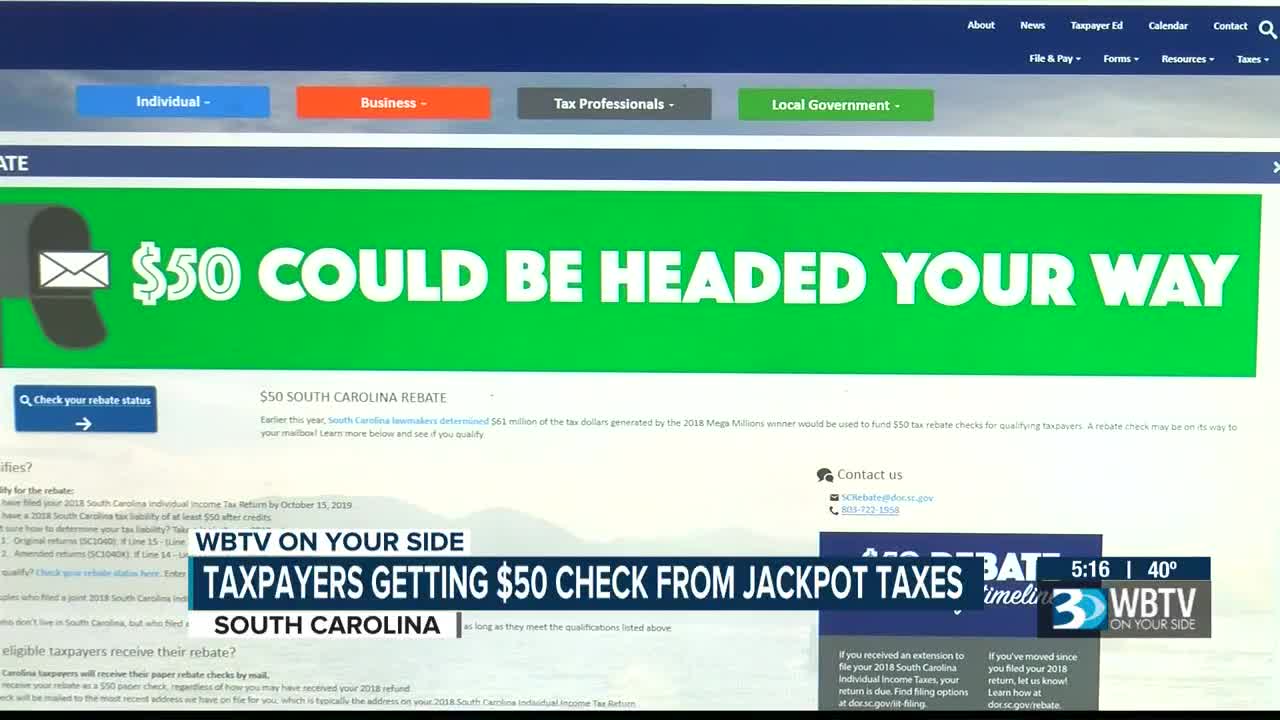

sc tax rebate status

Check the status of your rebate online. Those who filed their.

|

| When Will Your 50 Rebate Check Arrive In Sc Soon |

17 will receive a rebate of up to 800 by the end of the year.

. Anyone who filed taxes in 2021 with a taxable South Carolina income is eligible for the rebate. WCSC - The state of South Carolina says it has sent out more than 942 million in tax rebates to all eligible taxpayers who filed state tax returns by Oct. For general rebate information including how to track your rebate status online go to dorscgovrebate-2022 or call our dedicated rebate phone line 803-722-1958. Individual Income Tax return by Oct.

Check the status of your rebate online. Youll need your SSN or ITIN and line 10 from your 2021 SC Individual Income Tax Return. Follow these steps to determine your tax liability and rebate. Visit dorscgovrebate-2022 to get started.

If you e-filed your South Carolina state return and received a confirmation from your tax preparation software the SCDOR has received your return. About 44 of the states 25 million people who. Youll need your SSN or ITIN and line 10 from your 2021 SC Individual Income Tax Return. 17 will receive their rebate by the end of the year according to the SCDOR.

South carolina rebate. Of Revenue SCDOR November 13 2022 Rebates are capped at 800 so that means if the amount you calculated is between 1-799 you will receive the. The South Carolina Department of Revenue says it has finished issuing 2022 Individual Income Tax rebates to eligible taxpayers who filed returns by. According to an Associated Press article.

About 44 of the states 25 million people who file returns end up. SCDOR officials said 2022 Individual Income Tax rebates have been issued to eligible taxpayers. More than 139 million rebates over four weeks as direct deposits and paper. Any South Carolina taxpayer who paid 100 in taxes will receive the 100 rebate and that rebate will grow along with tax liability up to a cap of 800 per tax filing.

Taxpayers who filed their 2021 state returns by Oct. Sc stimulus update 2022. Individuals who earned less than 200000 in 2021 will receive a 50 income tax rebate while couples filing jointly with incomes under 400000 will receive 100. Download the SC5000 and email the completed and signed form to SCRebatedorscgov.

Manage Your South Carolina Tax Accounts Online Securely file pay and register most South Carolina taxes using the SCDORs free. Check the status of your South Carolina tax refund. You can track the status of the rebate online at dorscgovrebate-2022. If you didnt meet the deadline you have until Feb.

The rebate will give every South Carolinian who pays income tax the amount they pay back for this tax year up to about 800. Visit dorscgovrebate-2022 to get started. 15 to file a. In June South Carolina lawmakers agreed to earmark 1 billion of the states 138 billion budget for one-time tax rebates for residents.

Still waiting on your SC tax rebate. According to the department of revenue your rebate amount is based on your 2021 tax liability up to a cap of 800. You can expect your refund to. Approximately 139 million tax rebates totaling more than 942 million have been issued to taxpayers over the last four weeks the department announced on Wednesday.

Individuals who filed their 2021 SC. You will receive a paper check rebate so be sure to include your. Every South Carolinians who pays income tax should get that amount back for this tax year up to about 800. SC Dept.

South carolina 800.

|

| Tax Rebate 2022 South Carolina Residents Have Until Mid October To Claim Up To 700 Check Washington Examiner |

|

| South Carolina Tax Rebate Information |

|

| South Carolina Taxes Now Due On July 15 2020 Wltx Com |

|

| Wondering If You Will Receive A State Tax Rebate Sc Department Of Revenue Explains How To Know The Sumter Item |

|

| South Carolina Gov Mcmaster Signs Tax Cut Bill That Includes Refund Checks South Carolina Thecentersquare Com |

Posting Komentar untuk "sc tax rebate status"